Why multiple payment service licensings yet to bring the desired result?

By Rezaul Hossain | December 26, 2020

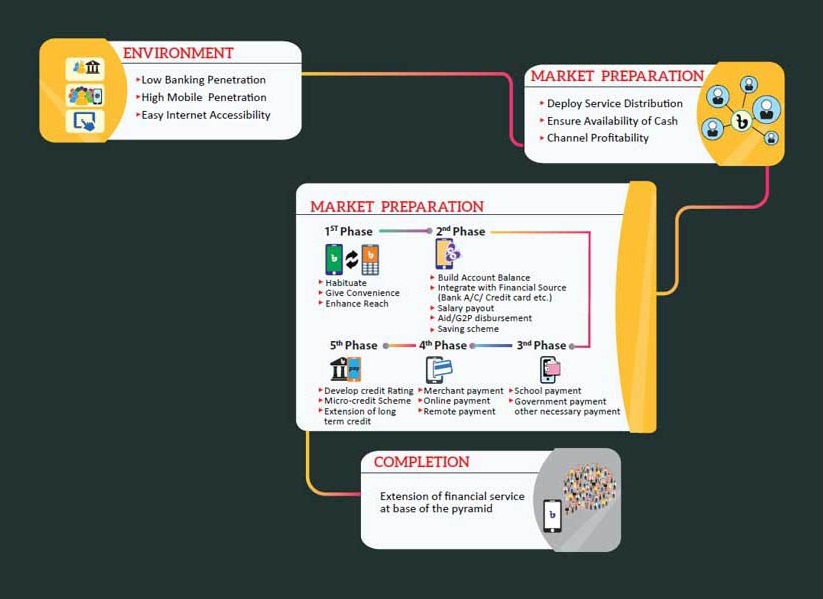

Banking has always been a tough business in Bangladesh because the revenue generated from customer transactions still lagged behind the expenditure of branch operations. So, retail banking always faces challenges to manage the cost of transaction vs revenue. Bangladesh Bank has taken timely initiatives to improve the inclusivity through the massive penetration of the users of mobile networks.

We are fully aware of the history. Despite all the drawbacks at the beginning of the journey, the regulator was flexible enough to adopt the successful model eventually in their guidelines. The current guideline is also promoting banks to have partners to do Mobile Financial Service (MFS) business after creating a third party company.

So, we can call them the operator because that third party entity can have its own brand, technology and customer base. The revenue stream of the said operators can come easily. Though it requires enormous investment, eventually it will pay off if an organization can do the right execution with the right segment with the proper structure, product and pricing.

Bangladesh bank introduced MFS licensing in 2011. With the first version of the regulation, 28 banks took the No objection certificate (NOC), 17 banks launched the operation, and only two operators were successful. Out of these two, only one is dominating the market.

Lately, another brand has emerged from outside the banking network as a challenger. It is quite interesting to observe that these three operators have three different models. Discussing the nuances of these models are out of the scope of this article.

From the regulator perspective, banks were not at all successful in doing this MFS business. The regulator gave guidelines for two more licenses to help banks, those are Payment System Operators (PSO) and Payment System Providers (PSP). As per my understanding, the regulator is thinking that those licenses will help banks to increase their penetration to the market and customer.

Through PSP you can have your wallet and can issue your own E-money. But you cannot cash-in through retail. You have to cash-in through banked people. And even you cannot cash out through outside; it has to be paid through the merchant or any other MFS operators.

To me, it is nothing but a half wallet where you do not have any control over your customer. What is the point of having a wallet without having any control over your customers? If a customer needs to pay through the wallet to any merchant, he can choose any MFS operator's wallet instead of choosing the wallet of a PSP.

You are spending money on your licensing, technology and brand, but for the customer, you are dependent on other parties. Just because of this, till now, there is no success story of PSP model and it won't be successful in the near future. The main point is that half wallet cannot survive with a full wallet in the same market.

PSO license, as an aggregator model, does not need any individual customer and a brand. So far, this is a feasible business model. This type of aggregators is helping not only banks but also a lot of individual MFS customers to do online transactions.

Bangladesh Bank also introduced another license called White Label ATM and Merchant Acquiring Services (WLAMA). In this, the license holder company can acquire merchants in the whole country. But again, it faces the same complicacy as PSP. In WLAMA, the licensee will spend money on license fees, technology and brand but it will not have its own customer.

It is dependent on banks or other parties to use the merchant network. Even it is not clear whether MFS operators will use it or they will have their own independent merchant network. If it is parallel, then where is the revenue stream? We should also know that acquiring merchants is very expensive. We are yet to see who will take the license and launch the service.

As I have said earlier to be an operator, you need some necessary elements- you need brand, customer, and technology to cater and capitalise on the market. To put things forward, I would like to examine the feasibility of these four licensing modules from the operators' perspective in terms of feasibility. Because if you have any plan to go for a business in these modules, you have to be able to understand the whole thing. Without proper ideas, the entire investment goes in vain. Before moving further, we must differentiate the four modules introduced by the Bangladesh Bank since 2011.

Apart from the operator business, if the regulator wants to make other business feasible, then it has to merge. It means that the WLAMA, PSO and PSP should be together under one license. It is meaningless to have separate licensing for all three.

It will be business-friendly as the revenue stream will be there if all are together. Business houses can do their business as per their investment and strength. Eventually, it will help banks and other MFS operators to grow, and they can focus on their core business.

Thus, it will increase the inclusivity eventually. Bangladesh Bank should bring PSO, PSP, and WLAMA under a single license to get more synergy, cost efficiency, and revenue stream.

Rezaul Hossain is a market transformation specialist

This article was originally published at THE BUSINESS STANDARD